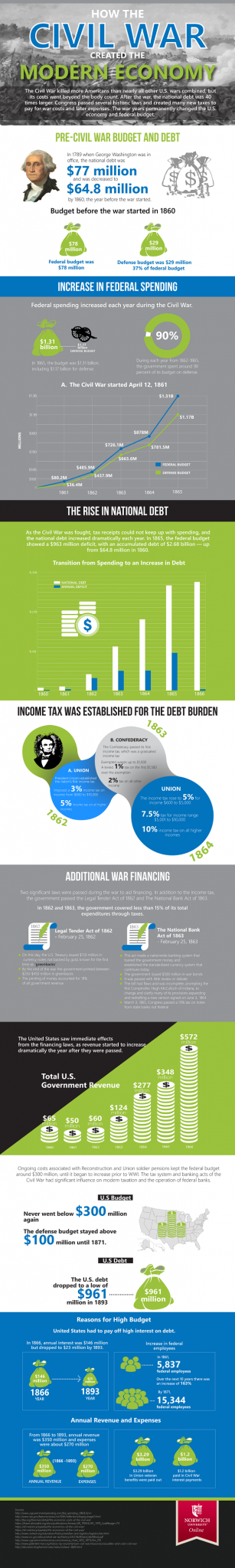

During the Civil War, more Americans died than in any other war the U.S. has ever been involved in. Funding the war also took a toll on the economy with the national debt rising 40 times over the pre-war levels. Congress was forced to pass historic laws and come up with new taxes to pay the cost of war and rebuild the country. These laws permanently changed the federal budget and U.S. economy.

To learn more, checkout the infographic below created by Norwich University’s Online Masters in Military History program.

Pre-War Debt and National Budget

When George Washington was president, in 1789, the national debt stood at $77 million. In the year preceding the Civil War, 1960, the national debt had reduced to $64.8 million. In the same financial year, the federal budget stood at $78 million. On the other hand, the defense budget was $29 million, which translates to 37% of the federal budget. From 1861, when the war started, to 1865 when it ended, the national and defense budgets increased year after year. Between 1862-1865, around 90% of the national budget was dedicated to defense. For instance, the federal budget in 1865 was $1.31 billion and the government spent $1.17 of it on defense.

The Rise in National Debt

As the Civil War progressed, the tax inflows could not keep up with government spending. The result was an increase in budget deficit ($931 million in 1865) and an accumulated debt of $2.68 billion (from a debt of $64.8 million in 1860). While the budget deficit reduced significantly in 1866, the accumulated national debt continued to rise.

Income Tax was Established for the Debt Burden

In 1862, the first income tax was established in the Union by President Lincoln. A 3% tax rate was imposed on individuals earning between $600-$10,000, while a 5% income tax was imposed on incomes exceeding $10,000. In 1863, the Confederacy also established its first graduated income tax which exempted wages up to $1,000 but imposed a 1% tax rate on the first $1,500 above the exemption and a 2% tax rate on all other income. As the cost of war continued to rise, the Union increased the income tax rate to bridge the budget deficit. A 5% tax rate was imposed on incomes ranging from $600 to $5,000 with a 7.5% tax rate on income ranging from $5,001 to $10,000. Higher incomes were taxed at the rate of 10%.

Additional War Financing

In addition to passing tax laws to help finance the war, the government also passed the Legal Tender Act in the year 1862. In 1863, the government also passed the National Bank Act.

Between 1862 and 1863, less than 15% of government expenditure was funded by tax revenue. When the Legal Tender Act of 1962 was enacted on February 25, 1962, the U.S. Treasury issued $150 million in currency notes (greenbacks), which were not backed by gold. Before the war ended, the government had printed between $250 million to $450 million in greenbacks. The printing of currency notes accounted for 18% of government revenue.

When the National Bank Act of 1863 was enacted on February 25, 1863, the national banking system was established and made it possible for the government to borrow from local banks. The Act also made it possible for the government to implement a standardized currency system currently in use. It also paved way for the government to issue war bonds worth $500 million.

After the two laws were enacted, government revenue increased significantly. In 1862, government revenue stood at $60 million, but this increased to $124 million in 1863 and $348 million in 1865.

In the aftermath of the Civil War, the government’s main expenses were Union soldiers’ pensions and reconstruction, which totaled $300 million a year. The tax laws and banking acts passed during the Civil War significantly influenced modern taxation and the federal banking system.

Federal Budget and Debt after the Civil War

Since the Civil War ended, the federal budget has never gone below $300 million again. On the other hand, the government’s defense budget stayed above $100 million until 1871. In 1893, U.S. debt had dropped to a low of $961 million

The main reason why the U.S. government continued to have a large budget after the war is because they had to continue paying off high interest rates on war-time debts. For instance, the government paid $146 million in 1866 as annual interest. However, the interest payment had dropped to $23 million a year in 1893. An increase in the number of federal employees also contributed to the government’s large budget.

Annual Revenue and Expenses

Between 1866 to 1893, annual revenue for the federal government was around $350 million while expenses stood at $270 million annually. During this period, the government paid out $3.29 billion in union veteran benefits and $1.2 billion in Civil War interest payments.